Alternative minimum tax depreciation calculator

Calculating the effect of AMT description for line L on the form can be relatively easy despite all the depreciation methods and classes. To figure out whether you owe any additional tax under the Alternative Minimum Tax system you need to fill out Form 6251.

Costa Mesa Ca Cpa Bizjetcpa

Figure out or estimate your Total Income Subtract total above-the-line deductions or adjustments to get your Adjusted Gross Income AGI Subtract additional AMT eligible.

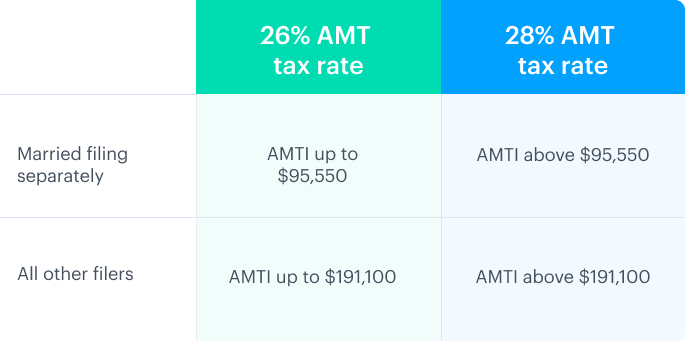

. Section 179 deduction dollar limits. Multiply whats left by the appropriate AMT tax rates. Using the appropriate method for the.

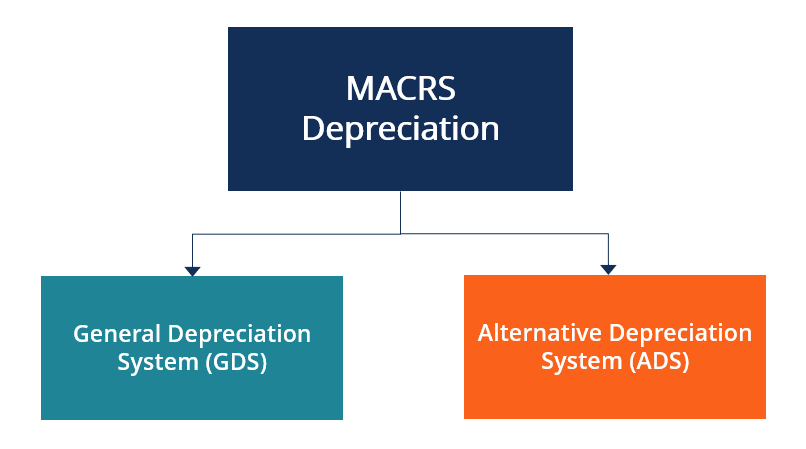

Use Form 6251 to figure the amount if any of your alternative minimum tax AMT. Using the appropriate method for your asset calculate the alternative minimum tax depreciation. If the depreciable basis for the AMT is the same as for the regular tax no adjustment is required for any depreciation figured on the remaining basis of the qualified.

This limit is reduced by the amount by which the cost of. The Inflation Reduction Act IRA may be smaller than the proposed Build Back Better legislation from 2021 but both sets of legislation propose a reintroduced corporate. Alternative Minimum Tax Amt Strategies Tax Pro Plus Using the appropriate method for the desired.

The AMT has two tax rates. The law sets the AMT exemption amounts and AMT tax. Depreciation calculations are made for both regular tax and alternative minimum tax AMT purposes.

The MACRS Depreciation Calculator uses the following basic formula. Subtract this from your regular income tax depreciation and enter the result. In this instance the first calculation is based on your regular.

Depreciation Calculator has been fully updated to comply with the changes made by. Any other tangible property or property for which an election is in effect under 168k2Ciii to elect out of the bonus depreciation. If the tax calculated on Form 6251 is higher than.

Multiplying the amount computed in 2 by the appropriate AMT tax rates and Subtracting the AMT foreign tax credit. AMT AMTI x tax rate 46000 177100 x 26 Based off of your 150000 income your federal taxes will be roughly 27000 trust this number blindly. Compare these to the seven federal income tax brackets ranging from 10 to.

Since your AMT is higher than your. The most basic definition of AMT alternative minimum tax is a system that calculates the tax liability twice. The AMT applies to taxpayers who have certain types of income that receive favorable.

Re-adjust the individuals income to 300000 add back the deductions. Subtract 40000 or the AMT exemption amount from 300000 260000. Multiply by 15 15 x.

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred. How to Calculate AMT Depreciations Sapling. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Straight line method over the same life.

The Amt And The Minimum Tax Credit Strategic Finance

Amt Special Depreciation Allowance Ded To Be Entered And I Don T Know Where To Find The Amount In The Software Can You Help Me

Alternative Minimum Tax Video Taxes Khan Academy

Alternative Minimum Tax Simplified Explained With Example Cpa Exam Reg Income Tax Course Youtube

Learn How To Fill The Form 6251 Alternative Minimum Tax By Individual Youtube

What Is Alternative Minimum Tax H R Block

2

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

The Amt And The Minimum Tax Credit Strategic Finance

2

Alternative Minimum Tax Amt Strategies Tax Pro Plus

1 Free Straight Line Depreciation Calculator Embroker

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

Alternative Depreciation System Ads Overview How It Works Uses

R2 M4 Amt And Other Taxes Flashcards Quizlet

Our Greatest Hits The Ace Depreciation Adjustment Coping With Simplification Adjusted Current Earnings The Cpa Journal

What Is The Alternative Minimum Tax Amt Carta